Think about it. Your car has a story to tell. A story about how you drive, how it feels, and what it needs. For decades, that story was locked away, a mystery under the hood. But that little port under your dashboard—the OBD-II connector—is the key. It’s the car’s own voice.

Now, we’re finally listening. And what we’re hearing is transforming two massive industries: insurance and auto repair. This isn’t just about a discount for safe driving anymore. It’s about a fundamental shift from reactive guessing to proactive, personalized care. Let’s dive into how using automotive OBD-II data is creating a future where your insurance bill and your maintenance schedule are uniquely, intelligently yours.

Beyond the Snapshot: The Rise of Truly Personalized Insurance

Remember when car insurance was basically a black box? You gave them your age, your car model, and your zip code, and they handed you a premium. It felt arbitrary. Well, usage-based insurance (UBI) started to change that, but early programs were… limited. They often just tracked mileage and hard braking.

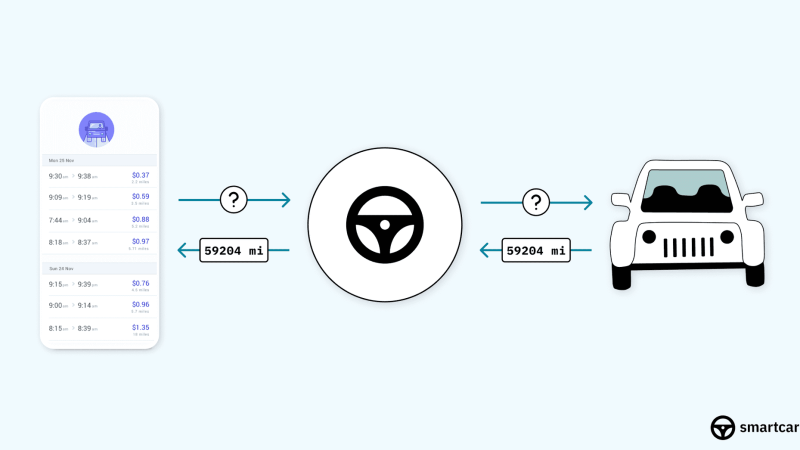

Modern OBD-II dongles and connected car systems go so much deeper. They’re not just a snapshot; they’re a high-definition movie of your driving habits. Here’s what insurers can now see—and more importantly, how it can work for you.

What’s Actually in the Data?

We’re talking about a rich stream of information: speed, acceleration, cornering force, time of day you drive, even your consistent routes. But it’s the context that matters. Accelerating quickly onto a highway is different from doing it in a school zone. The algorithms are getting smart enough to know the difference.

Honestly, this granularity allows for fairness that old models couldn’t touch. A safe driver in a “high-risk” postal code shouldn’t be penalized forever. Their data can prove their real-world risk.

The Real-World Benefits (And a Few Caveats)

For the conscientious driver, the perks are tangible. We’re talking significant premium reductions, sometimes 20-30% or more. You get direct feedback on your habits, which can genuinely make you a safer, more fuel-efficient driver. It turns insurance from a static bill into a dynamic part of your driving life.

That said… privacy concerns are real and valid. You need to know exactly what data is being collected, how long it’s stored, and who it might be shared with. The best programs are transparent and put you in control. The key is telematics for personalized insurance that feels like a partnership, not surveillance.

From “Check Engine” to Crystal Ball: Predictive Maintenance

This is where it gets really exciting for your wallet and your peace of mind. The “check engine” light is famously unhelpful—a terrifyingly vague symptom of a thousand possible problems. OBD-II data flips the script. Instead of waiting for a catastrophic failure, we can now monitor the vehicle’s vital signs for early, subtle warnings.

Think of it like a fitness tracker for your car. It notices the slight irregularity long before the heart attack.

How Predictive Maintenance Actually Works

Advanced algorithms analyze live OBD-II parameters—things like engine temperature variance, subtle misfire counts, fuel trim deviations, and even battery health metrics. They establish a baseline of “normal” for your specific vehicle. When something starts to drift, it triggers an alert.

- You get a notification: “Your oxygen sensor is showing early signs of degradation. Schedule service in the next 500 miles.”

- You avoid a domino effect: Fixing that small sensor prevents it from damaging the catalytic converter—saving you thousands.

- You plan ahead: No more surprise breakdowns. You schedule repairs at your convenience, often at a lower cost because the repair is simpler.

This is the core of predictive vehicle maintenance using OBD2. It’s proactive, not panic-driven.

The Data-Driven Service Visit

Imagine walking into a service center not saying, “My car sounds funny,” but instead handing them a report: “Here’s the data stream showing a 15% drop in fuel efficiency correlated with rising engine load readings at highway speeds.” That changes the entire conversation. It turns a diagnostic mystery into a targeted procedure. Saves you time, saves the mechanic time.

The Convergence: When Insurance and Maintenance Data Meet

Here’s where things get futuristic. These two data streams aren’t destined to stay separate. In fact, they’re starting to merge, and the implications are huge.

An insurer, with your permission, could see that you’re maintaining your vehicle impeccably based on predictive alerts and service records. That makes you a lower risk. Could that lead to an even better rate? Potentially. Some forward-thinking companies are already exploring this.

Conversely, your driving data could inform maintenance. Aggressive driving in a certain pattern might mean you need brake service sooner than a gentle driver. The car’s own story tailors its care plan.

| Traditional Model | OBD-II Data-Driven Model |

| Insurance based on proxies (age, location) | Insurance based on actual behavior |

| Reactive “fix-it-when-it-breaks” maintenance | Proactive care based on vehicle health trends |

| Surprise costs and downtime | Planned, often lower-cost interventions |

| One-size-fits-all | Deeply personalized for driver and vehicle |

Navigating the New Landscape: What You Should Know

Okay, so this all sounds good in theory. But how do you, you know, actually engage with it? A few thoughts.

First, ask questions. If you’re considering a UBI insurance program, get the data policy in writing. Know your rights. Second, for maintenance, look for repair shops or fleet management services that offer data-driven diagnostics. They’re out there and growing. Finally, a simple Bluetooth OBD-II reader and a savvy app can give you a ton of this insight yourself—it’s not just for the pros anymore.

The trend is clear: transparency and personalization are winning. We’re moving away from a world where cars are mysterious black boxes we just pour money into. We’re entering an era of partnership, where data empowers us to drive safer, spend smarter, and understand the machine we depend on every day.

Your car has been ready to talk for a long time. Maybe it’s time we all started listening a little more closely.