Let’s be honest. Car insurance has felt… static for a long time. You pay a premium based on broad categories—your age, your zip code, your car model. It can feel impersonal, even unfair. But what if your bill could reflect your actual driving? That’s the promise of Usage-Based Insurance, or UBI.

Here’s the deal: UBI programs use technology—a plug-in device, a mobile app, or your car’s built-in system—to track how you drive. Think mileage, time of day, braking habits, and speed. In return for sharing this data, you could snag a significant discount. Sounds great, right? Well, it is. But it also opens a complex door to questions about data privacy for the modern driver.

How Does UBI Actually Work? The Tech Behind the Discount

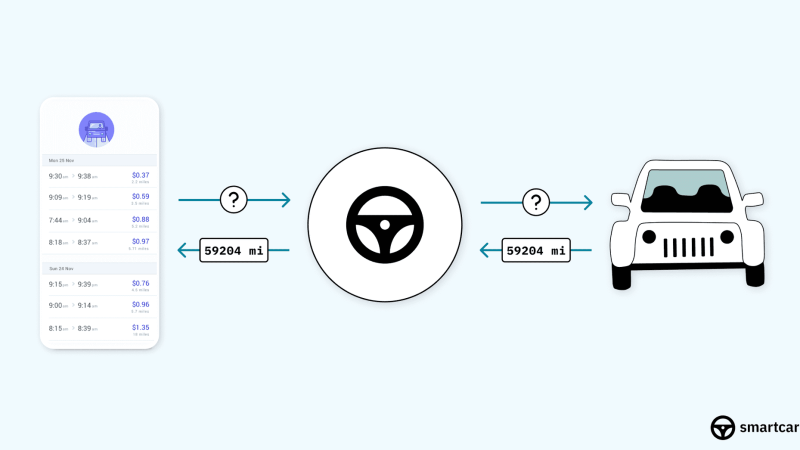

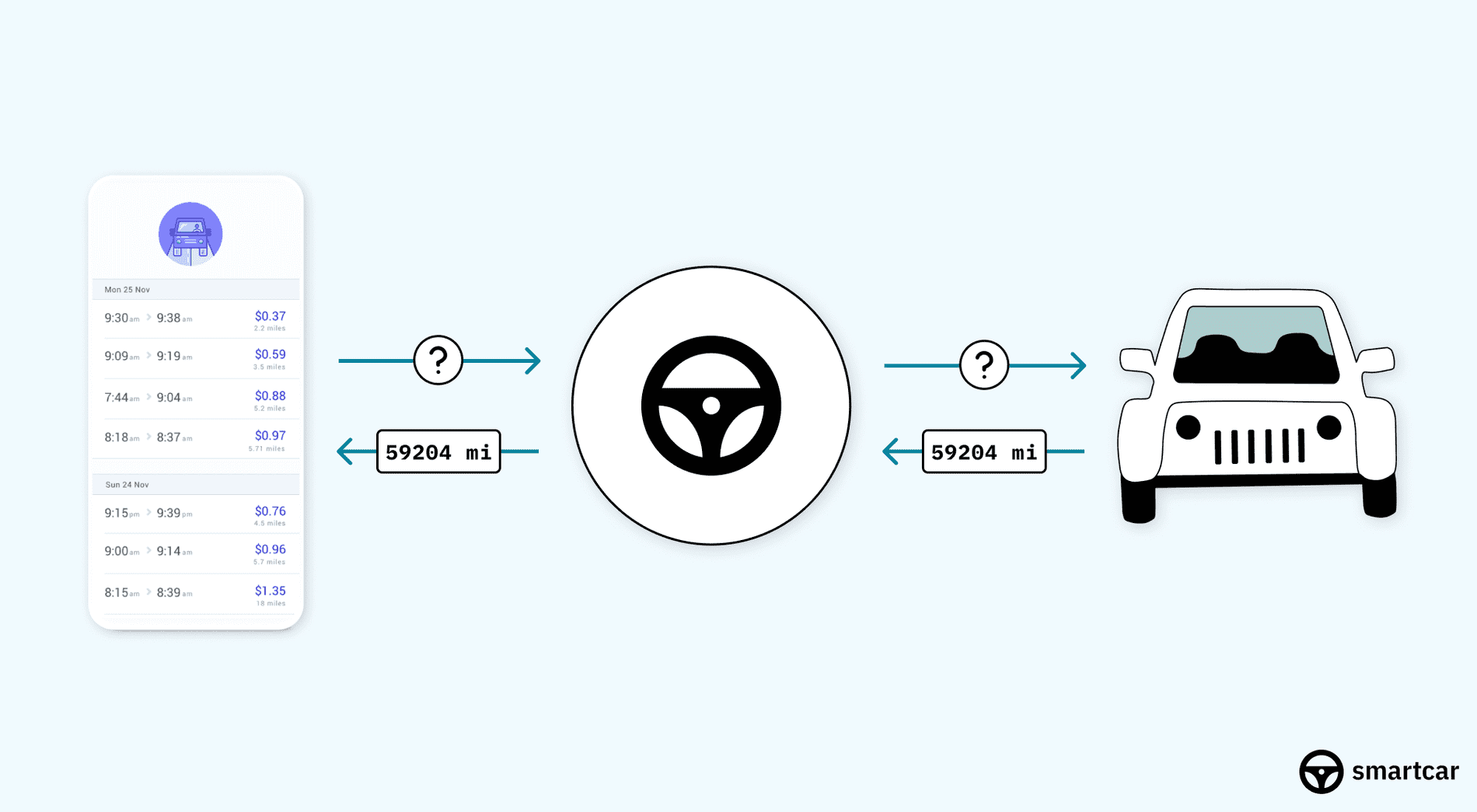

It’s not magic, it’s telematics. That’s just a fancy word for the tech that collects and transmits your driving data. Insurers typically offer a few paths:

- Plug-in Devices (OBD-II): A small gadget you plug into your car’s diagnostic port. It’s been around a while and tracks a wide range of metrics.

- Mobile Apps: Honestly, the most common now. You download your insurer’s app, it uses your phone’s sensors (GPS, accelerometer) to monitor trips.

- Embedded Systems: For newer cars. The car’s own connected services (like OnStar or BMW ConnectedDrive) share data directly with the insurer.

They’re not just tracking “bad” behavior. Sure, hard braking and rapid acceleration are factors. But they also look at mileage (low is usually better), the times you drive (3 a.m. trips might raise a flag), and even your phone use while driving if the app has permission. It’s a holistic, minute-by-minute snapshot of your life on the road.

The Privacy Paradox: What Data Is Collected, Really?

This is where the rubber meets the road, privacy-wise. You’re not just sharing that you’re a safe driver. You’re generating a digital footprint of your movements and habits. Let’s break down what that can include:

| Data Type | What It Is | Potential Privacy Concern |

| Trip Details | Start/end times, routes, distances, destinations. | Creates a pattern-of-life map. Where you live, work, worship, socialize. |

| Driving Behavior | Speed, braking, cornering, acceleration force. | Can be used to reconstruct specific driving events, possibly in claims. |

| Vehicle Data | Engine RPM, odometer, diagnostic trouble codes. | Reveals vehicle health and maintenance habits. |

| Mobile Data (if using an app) | Phone handling, device orientation during trips. | Infers distracted driving, even if you weren’t the one touching the phone. |

It’s a lot. And the concern isn’t necessarily that your insurer will sell your trip to the grocery store. It’s about data aggregation, security, and secondary use. Could this data be used to deny a claim if you were 2 mph over the limit? Could it be shared with data brokers or, if subpoenaed, used in a court case? These are the murky, modern questions.

Who Owns Your Driving Data? A Key Question

You’d think it’s yours. And legally, in many places, you have rights to it. But in practice, when you enroll in a UBI program, you’re granting the insurer a license to collect, use, and often store that data. The fine print in the terms and conditions—the one we all scroll past—holds the answers.

Most reputable companies state they use the data primarily for pricing and discounts. But policies on data retention (how long they keep it), sharing with affiliates, and use in claim disputes vary wildly. That’s your homework before you opt-in.

Navigating the Trade-Off: Savings vs. Surveillance

So, is it worth it? For many, absolutely. The savings can be substantial, sometimes over 20-30%. It rewards safe, low-mileage drivers directly. But you have to go in with your eyes open. Think of it less like a surveillance state and more like a performance review for your driving—with tangible rewards.

Here’s how to engage with UBI smartly, protecting your privacy while chasing the discount:

- Read the Data Policy. Seriously. I know, it’s tedious. But look for clauses on data sharing, sale to third parties, and use in claims. If it’s vague, that’s a red flag.

- Ask About “Trip View” or Location Details. Some programs only share driving behavior scores, not specific route maps. This is a huge privacy win. Opt for those if available.

- Understand the Scoring Model. What exactly gives you a good score? Knowing this lets you drive naturally while still optimizing for the discount.

- Inquire About Data Deletion. If you leave the program, can you request your data be deleted? A company’s answer tells you a lot about their respect for consumer privacy.

The Future is Already Here: A Glimpse at What’s Next

UBI is evolving into something even more integrated. With the rise of electric and fully autonomous vehicles, the data stream will get richer. Insurers might monitor charging habits, battery health, or even your choice of in-car entertainment. The line between insuring a vehicle and insuring a digital experience is blurring.

This makes robust data privacy laws and transparent consumer consent more critical than ever. The modern consumer needs to be both data-savvy and privacy-aware.

Final Thoughts: Driving Your Own Data Destiny

Look, UBI isn’t inherently good or bad. It’s a tool. A powerful one that flips the old insurance model on its head. The discount is real. The convenience of a mobile app is undeniable. But the value of your personal data—your geographic and behavioral fingerprint—is also real.

The power, oddly enough, is in your hands. You get to choose. You can decide the trade-off is worth it. You can decide which company’s data practices you trust. Or you can decide the old-fashioned model suits you just fine. The key is to make that choice not out of ignorance, but with a clear understanding of what’s being exchanged.

In the modern economy, data is the currency. When it comes to your car insurance, you’re now in a position to negotiate the exchange rate.